Carbonite Inc (NASDAQ:CARB) SVP Norman Guadagno sold 1,280 shares of Carbonite stock in a transaction dated Friday, July 27th. The shares were sold at an average price of $36.20, for a total transaction of $46,336.00. The sale was disclosed in a filing with the SEC, which is accessible through this link.

Carbonite Inc (NASDAQ:CARB) SVP Norman Guadagno sold 1,280 shares of Carbonite stock in a transaction dated Friday, July 27th. The shares were sold at an average price of $36.20, for a total transaction of $46,336.00. The sale was disclosed in a filing with the SEC, which is accessible through this link.

Carbonite opened at $34.60 on Thursday, MarketBeat.com reports. The stock has a market cap of $989.49 million, a P/E ratio of 65.96 and a beta of 0.28. Carbonite Inc has a 52-week low of $18.55 and a 52-week high of $41.25. The company has a current ratio of 0.73, a quick ratio of 0.73 and a debt-to-equity ratio of 3.02.

Get Carbonite alerts:Carbonite (NASDAQ:CARB) last released its earnings results on Monday, May 7th. The technology company reported $0.27 earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of $0.22 by $0.05. The firm had revenue of $64.03 million for the quarter, compared to analyst estimates of $63.51 million. Carbonite had a return on equity of 35.49% and a net margin of 0.14%. Carbonite’s revenue was up 12.1% compared to the same quarter last year. During the same period in the previous year, the company earned $0.09 earnings per share. sell-side analysts anticipate that Carbonite Inc will post 1.02 earnings per share for the current fiscal year.

A number of research analysts recently issued reports on CARB shares. Zacks Investment Research raised Carbonite from a “hold” rating to a “buy” rating and set a $39.00 target price on the stock in a report on Thursday, May 10th. B. Riley lifted their target price on Carbonite to $37.00 and gave the stock a “buy” rating in a report on Tuesday, May 8th. Craig Hallum reaffirmed a “buy” rating and set a $30.00 target price on shares of Carbonite in a report on Tuesday, May 8th. Lake Street Capital lifted their target price on Carbonite from $27.00 to $34.00 and gave the stock a “buy” rating in a report on Tuesday, May 8th. Finally, Rosenblatt Securities reaffirmed a “buy” rating and set a $31.00 target price on shares of Carbonite in a report on Sunday, May 6th. Two investment analysts have rated the stock with a sell rating, one has issued a hold rating and seven have given a buy rating to the stock. Carbonite currently has a consensus rating of “Buy” and a consensus target price of $35.38.

A number of large investors have recently added to or reduced their stakes in CARB. ETF Managers Group LLC acquired a new position in Carbonite during the first quarter worth about $52,523,000. Millennium Management LLC purchased a new position in Carbonite in the 1st quarter worth about $5,825,000. Carillon Tower Advisers Inc. purchased a new position in Carbonite in the 1st quarter worth about $5,325,000. Summit Trail Advisors LLC increased its stake in Carbonite by 3,277.3% in the 1st quarter. Summit Trail Advisors LLC now owns 120,436 shares of the technology company’s stock worth $120,000 after purchasing an additional 116,870 shares in the last quarter. Finally, Lyon Street Capital LLC increased its stake in Carbonite by 23.0% in the 1st quarter. Lyon Street Capital LLC now owns 372,416 shares of the technology company’s stock worth $10,726,000 after purchasing an additional 69,520 shares in the last quarter. 94.79% of the stock is currently owned by hedge funds and other institutional investors.

About Carbonite

Carbonite, Inc, together with its subsidiaries, provides backup, disaster recovery, high availability, and workload migration technology solutions in the United States. Its solutions include Carbonite Safe that offers annual and multi-year cloud backup plans for individuals or businesses; and Carbonite Endpoint Protection that protects the data, which resides on an organization's computers, laptops, tablets, and smartphones.

Recommended Story: Are analyst ratings accurate?

Ashford Hospitality Trust Inc (NYSE:AHT) has been assigned an average recommendation of “Hold” from the seven brokerages that are presently covering the firm, Marketbeat reports. One analyst has rated the stock with a sell recommendation, three have given a hold recommendation and three have given a buy recommendation to the company. The average twelve-month target price among brokers that have covered the stock in the last year is $8.00.

Ashford Hospitality Trust Inc (NYSE:AHT) has been assigned an average recommendation of “Hold” from the seven brokerages that are presently covering the firm, Marketbeat reports. One analyst has rated the stock with a sell recommendation, three have given a hold recommendation and three have given a buy recommendation to the company. The average twelve-month target price among brokers that have covered the stock in the last year is $8.00.  The most surprising facts about Warren Buffett before he became a billionaire 4:55 PM ET Fri, 4 May 2018 | 01:34

The most surprising facts about Warren Buffett before he became a billionaire 4:55 PM ET Fri, 4 May 2018 | 01:34  Warren Buffett's secret to investing lays in the game of baseball 2:26 PM ET Thu, 2 Feb 2017 | 00:48

Warren Buffett's secret to investing lays in the game of baseball 2:26 PM ET Thu, 2 Feb 2017 | 00:48  Kylie Jenner turned a $29 lipstick into a $420 million beauty empire 8:33 AM ET Thu, 14 Sept 2017 | 01:12

Kylie Jenner turned a $29 lipstick into a $420 million beauty empire 8:33 AM ET Thu, 14 Sept 2017 | 01:12

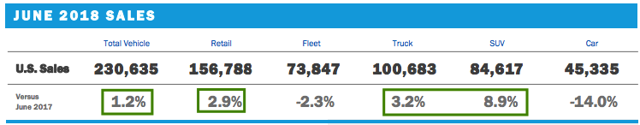

Source: Ford

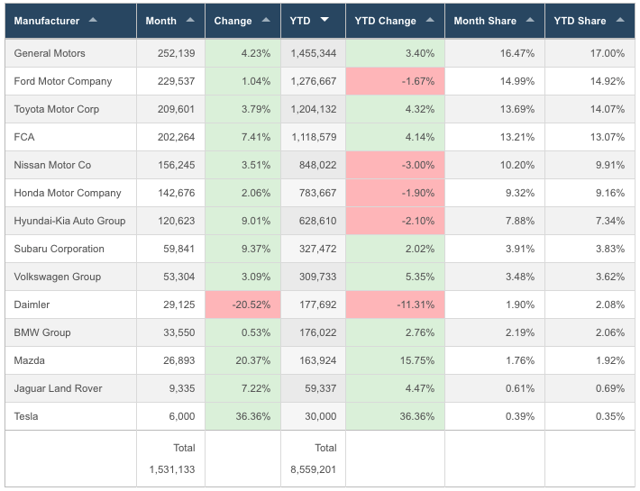

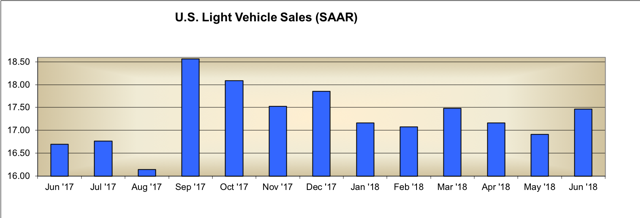

Source: Ford Source: Goodcarbadcar

Source: Goodcarbadcar Source: Motor Intelligence

Source: Motor Intelligence  Source: Ford Sales Report June 2018

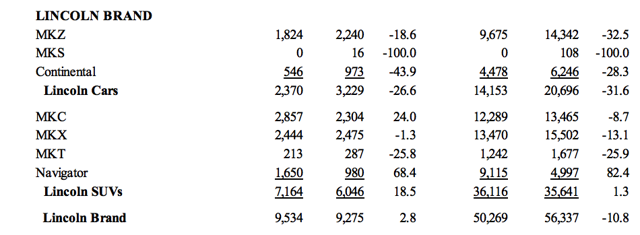

Source: Ford Sales Report June 2018 Source: Ford Sales Report June 2018

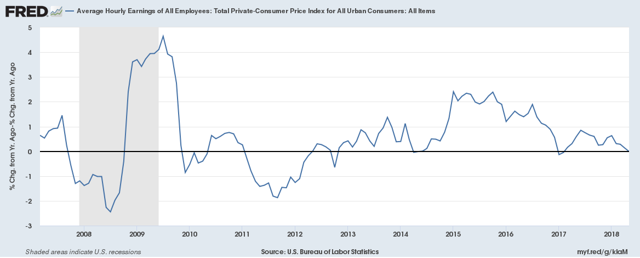

Source: Ford Sales Report June 2018 That being said, I also look at the difference between average hourly earnings growth and the consumer price index to see if the trend from cars to SUVs and trucks might be in danger. It is clearly visible that consumers did benefit from outperforming earnings growth between 2015 and 2017. The trend from cars to bigger vehicles started during this period.

That being said, I also look at the difference between average hourly earnings growth and the consumer price index to see if the trend from cars to SUVs and trucks might be in danger. It is clearly visible that consumers did benefit from outperforming earnings growth between 2015 and 2017. The trend from cars to bigger vehicles started during this period. Takeaway

Takeaway  DnB Asset Management AS increased its position in The Coca-Cola Co (NYSE:KO) by 1.5% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 919,833 shares of the company’s stock after buying an additional 13,500 shares during the quarter. DnB Asset Management AS’s holdings in The Coca-Cola were worth $40,344,000 at the end of the most recent reporting period.

DnB Asset Management AS increased its position in The Coca-Cola Co (NYSE:KO) by 1.5% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 919,833 shares of the company’s stock after buying an additional 13,500 shares during the quarter. DnB Asset Management AS’s holdings in The Coca-Cola were worth $40,344,000 at the end of the most recent reporting period.  24/7 Wall St.

24/7 Wall St. Avista Corporation operates as an electric and natural gas utility company. It operates through two segments, Avista Utilities and AEL&P. The Avista Utilities segment provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho; and natural gas distribution services in parts of northeastern and southwestern Oregon, as well as generates electricity in Washington, Idaho, Oregon, and Montana. This segment also engages in the wholesale purchase and sale of electricity and natural gas. The AEL&P segment offers electric services to approximately 17,000 customers in the city and borough of Juneau, Alaska. The company generates electricity through hydro, thermal, and wind facilities. As of February 21, 2018, it supplied retail electric services to approximately 382,000 customers and retail natural gas service to approximately 347,000 customers. In addition, the company engages in sheet metal fabrication, venture fund investments, real estate investments, and other investments. Avista Corporation was founded in 1889 and is headquartered in Spokane, Washington.

Avista Corporation operates as an electric and natural gas utility company. It operates through two segments, Avista Utilities and AEL&P. The Avista Utilities segment provides electric distribution and transmission, and natural gas distribution services in parts of eastern Washington and northern Idaho; and natural gas distribution services in parts of northeastern and southwestern Oregon, as well as generates electricity in Washington, Idaho, Oregon, and Montana. This segment also engages in the wholesale purchase and sale of electricity and natural gas. The AEL&P segment offers electric services to approximately 17,000 customers in the city and borough of Juneau, Alaska. The company generates electricity through hydro, thermal, and wind facilities. As of February 21, 2018, it supplied retail electric services to approximately 382,000 customers and retail natural gas service to approximately 347,000 customers. In addition, the company engages in sheet metal fabrication, venture fund investments, real estate investments, and other investments. Avista Corporation was founded in 1889 and is headquartered in Spokane, Washington. United Utilities Group PLC provides water and wastewater services in the United Kingdom. It is also involved in renewable energy generation, corporate trustee, and property management activities; and the provision of consulting and project management services. The company operates 43,000 kilometers (km) of pipes; 77,000 km of sewerage pipes; 567 wastewater treatment works; and 91 water treatment works. It serves 3 million households and 200,000 business customers. United Utilities Group PLC was incorporated in 2008 and is based in Warrington, the United Kingdom.

United Utilities Group PLC provides water and wastewater services in the United Kingdom. It is also involved in renewable energy generation, corporate trustee, and property management activities; and the provision of consulting and project management services. The company operates 43,000 kilometers (km) of pipes; 77,000 km of sewerage pipes; 567 wastewater treatment works; and 91 water treatment works. It serves 3 million households and 200,000 business customers. United Utilities Group PLC was incorporated in 2008 and is based in Warrington, the United Kingdom.

GAP (NYSE:GPS) had its target price reduced by Credit Suisse Group from $35.00 to $33.00 in a report released on Friday morning. They currently have a neutral rating on the apparel retailer’s stock.

GAP (NYSE:GPS) had its target price reduced by Credit Suisse Group from $35.00 to $33.00 in a report released on Friday morning. They currently have a neutral rating on the apparel retailer’s stock. ADVA Optical Networking SE develops, manufactures, and sells optical and Ethernet-based networking solutions to deliver data, storage, voice, and video services worldwide. It offers scalable optical transport solutions, such as FSP 3000 AgileConnect, FSP 3000 CloudConnect, and FSP 3000 AccessConnect; packet edge and aggregation products, including carrier Ethernet and programmable demarcation, edge aggregation, and edge computing products; and network virtualization products comprising ensemble connectors, controllers, and orchestrators. The company also provides timing and synchronization products; network infrastructure assurance products; and automated network management products, such as FSP service manager, FSP network manager, FSP network hypervisor, ensemble portal, and Pro-Vision products that offer a unified platform for network operations. In addition, it provides professional services to plan, operate, and maintain the networks. The company sells its products to telecommunications service providers, private companies, universities, and government agencies directly, as well as through a network of distribution partners. The company was founded in 1994 and is headquartered in Munich, Germany.

ADVA Optical Networking SE develops, manufactures, and sells optical and Ethernet-based networking solutions to deliver data, storage, voice, and video services worldwide. It offers scalable optical transport solutions, such as FSP 3000 AgileConnect, FSP 3000 CloudConnect, and FSP 3000 AccessConnect; packet edge and aggregation products, including carrier Ethernet and programmable demarcation, edge aggregation, and edge computing products; and network virtualization products comprising ensemble connectors, controllers, and orchestrators. The company also provides timing and synchronization products; network infrastructure assurance products; and automated network management products, such as FSP service manager, FSP network manager, FSP network hypervisor, ensemble portal, and Pro-Vision products that offer a unified platform for network operations. In addition, it provides professional services to plan, operate, and maintain the networks. The company sells its products to telecommunications service providers, private companies, universities, and government agencies directly, as well as through a network of distribution partners. The company was founded in 1994 and is headquartered in Munich, Germany. UTStarcom Holdings Corp., together with its subsidiaries, operates as a telecom infrastructure provider to develop technology for bandwidth from cloud-based services, mobile, streaming, and other applications. The company offers broadband packet optical transport and wireless/fixed-line access products and solutions. It focuses on delivering carrier-class broadband transport and access products and solutions optimized for mobile backhaul, metro aggregation, broadband access, Wi-Fi data, and value added services. The company provides optical transport products, such as packet transport network, next generation packet transport network, and SyncRing product lines that convert and translate data, video, voice, or other traffic into an optical signal that is transmitted over glass fiber; and SOO network (software-defined open packet optical) solution, which helps telecom operators to address the challenges related to the growth of mobile and cloud services, media streaming, and social networking, as well as new applications and services. It also offers carrier Wi-Fi products, such as solutions for managed wireless access networks, including wireless access controllers, VAS platforms, network management systems, and Wi-Fi access points for carrier and MSO markets, as well as various deployment scenarios; and a range of services, such as IPTV, high-speed Internet access, POTS, ISDN, VoIP, over twisted pair copper, and optical fiber. The company was founded in 1991 and is based in Admiralty, Hong Kong.

UTStarcom Holdings Corp., together with its subsidiaries, operates as a telecom infrastructure provider to develop technology for bandwidth from cloud-based services, mobile, streaming, and other applications. The company offers broadband packet optical transport and wireless/fixed-line access products and solutions. It focuses on delivering carrier-class broadband transport and access products and solutions optimized for mobile backhaul, metro aggregation, broadband access, Wi-Fi data, and value added services. The company provides optical transport products, such as packet transport network, next generation packet transport network, and SyncRing product lines that convert and translate data, video, voice, or other traffic into an optical signal that is transmitted over glass fiber; and SOO network (software-defined open packet optical) solution, which helps telecom operators to address the challenges related to the growth of mobile and cloud services, media streaming, and social networking, as well as new applications and services. It also offers carrier Wi-Fi products, such as solutions for managed wireless access networks, including wireless access controllers, VAS platforms, network management systems, and Wi-Fi access points for carrier and MSO markets, as well as various deployment scenarios; and a range of services, such as IPTV, high-speed Internet access, POTS, ISDN, VoIP, over twisted pair copper, and optical fiber. The company was founded in 1991 and is based in Admiralty, Hong Kong. Shares of Hologic, Inc. (NASDAQ:HOLX) have been given a consensus recommendation of “Hold” by the eighteen brokerages that are presently covering the firm, Marketbeat reports. Three equities research analysts have rated the stock with a sell recommendation, five have assigned a hold recommendation and nine have given a buy recommendation to the company. The average 12 month price objective among brokerages that have updated their coverage on the stock in the last year is $45.00.

Shares of Hologic, Inc. (NASDAQ:HOLX) have been given a consensus recommendation of “Hold” by the eighteen brokerages that are presently covering the firm, Marketbeat reports. Three equities research analysts have rated the stock with a sell recommendation, five have assigned a hold recommendation and nine have given a buy recommendation to the company. The average 12 month price objective among brokerages that have updated their coverage on the stock in the last year is $45.00.