Ashford Hospitality Trust Inc (NYSE:AHT) has been assigned an average recommendation of “Hold” from the seven brokerages that are presently covering the firm, Marketbeat reports. One analyst has rated the stock with a sell recommendation, three have given a hold recommendation and three have given a buy recommendation to the company. The average twelve-month target price among brokers that have covered the stock in the last year is $8.00.

Ashford Hospitality Trust Inc (NYSE:AHT) has been assigned an average recommendation of “Hold” from the seven brokerages that are presently covering the firm, Marketbeat reports. One analyst has rated the stock with a sell recommendation, three have given a hold recommendation and three have given a buy recommendation to the company. The average twelve-month target price among brokers that have covered the stock in the last year is $8.00.

A number of analysts recently commented on the stock. Zacks Investment Research downgraded shares of Ashford Hospitality Trust from a “hold” rating to a “sell” rating in a report on Monday, March 26th. Robert W. Baird boosted their price objective on shares of Ashford Hospitality Trust from $7.00 to $8.00 and gave the stock a “neutral” rating in a report on Wednesday, June 27th.

Get Ashford Hospitality Trust alerts:Shares of NYSE:AHT traded down $0.01 during midday trading on Friday, hitting $8.18. The stock had a trading volume of 334,900 shares, compared to its average volume of 509,552. The company has a market cap of $795.99 million, a price-to-earnings ratio of 5.94, a PEG ratio of 1.30 and a beta of 1.30. The company has a quick ratio of 3.67, a current ratio of 3.67 and a debt-to-equity ratio of 6.36. Ashford Hospitality Trust has a 1 year low of $5.42 and a 1 year high of $8.66.

Ashford Hospitality Trust (NYSE:AHT) last issued its earnings results on Thursday, May 3rd. The real estate investment trust reported ($0.39) earnings per share for the quarter, meeting the Thomson Reuters’ consensus estimate of ($0.39). The business had revenue of $342.21 million for the quarter, compared to the consensus estimate of $349.42 million. Ashford Hospitality Trust had a negative net margin of 4.75% and a negative return on equity of 10.19%. research analysts forecast that Ashford Hospitality Trust will post 1.25 EPS for the current year.

The business also recently disclosed a quarterly dividend, which was paid on Monday, July 16th. Investors of record on Friday, June 29th were issued a dividend of $0.12 per share. This represents a $0.48 dividend on an annualized basis and a yield of 5.87%. The ex-dividend date of this dividend was Thursday, June 28th. Ashford Hospitality Trust’s dividend payout ratio is currently 35.04%.

In related news, Director Alan Tallis sold 20,000 shares of the business’s stock in a transaction dated Thursday, July 5th. The shares were sold at an average price of $8.42, for a total transaction of $168,400.00. The transaction was disclosed in a filing with the SEC, which is accessible through this link. In the last three months, insiders have sold 40,900 shares of company stock worth $339,406. 18.20% of the stock is owned by insiders.

A number of institutional investors and hedge funds have recently made changes to their positions in AHT. Matarin Capital Management LLC acquired a new position in Ashford Hospitality Trust during the first quarter worth about $5,949,000. Renaissance Technologies LLC raised its position in Ashford Hospitality Trust by 29.4% during the fourth quarter. Renaissance Technologies LLC now owns 3,575,500 shares of the real estate investment trust’s stock worth $24,063,000 after acquiring an additional 811,400 shares during the last quarter. Millennium Management LLC raised its position in Ashford Hospitality Trust by 58.6% during the fourth quarter. Millennium Management LLC now owns 1,166,225 shares of the real estate investment trust’s stock worth $7,849,000 after acquiring an additional 431,065 shares during the last quarter. Global X Management Co. LLC raised its position in Ashford Hospitality Trust by 28.7% during the first quarter. Global X Management Co. LLC now owns 1,636,644 shares of the real estate investment trust’s stock worth $10,573,000 after acquiring an additional 364,506 shares during the last quarter. Finally, Thrivent Financial For Lutherans acquired a new position in Ashford Hospitality Trust during the fourth quarter worth about $2,319,000. Institutional investors own 72.33% of the company’s stock.

About Ashford Hospitality Trust

Ashford Hospitality Trust is a real estate investment trust (REIT) focused on investing opportunistically in the hospitality industry in upper upscale, full-service hotels.

Read More: What do I need to know about analyst ratings?

The most surprising facts about Warren Buffett before he became a billionaire 4:55 PM ET Fri, 4 May 2018 | 01:34

The most surprising facts about Warren Buffett before he became a billionaire 4:55 PM ET Fri, 4 May 2018 | 01:34  Warren Buffett's secret to investing lays in the game of baseball 2:26 PM ET Thu, 2 Feb 2017 | 00:48

Warren Buffett's secret to investing lays in the game of baseball 2:26 PM ET Thu, 2 Feb 2017 | 00:48  Kylie Jenner turned a $29 lipstick into a $420 million beauty empire 8:33 AM ET Thu, 14 Sept 2017 | 01:12

Kylie Jenner turned a $29 lipstick into a $420 million beauty empire 8:33 AM ET Thu, 14 Sept 2017 | 01:12

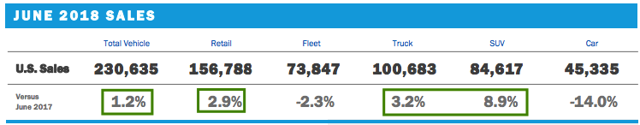

Source: Ford

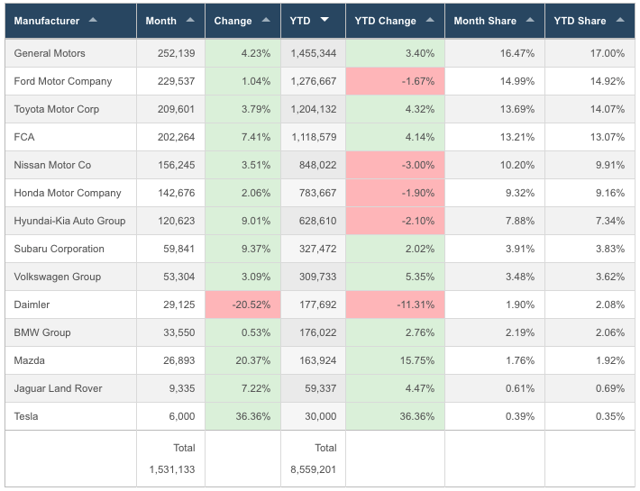

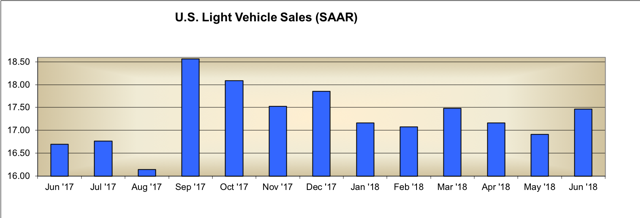

Source: Ford Source: Goodcarbadcar

Source: Goodcarbadcar Source: Motor Intelligence

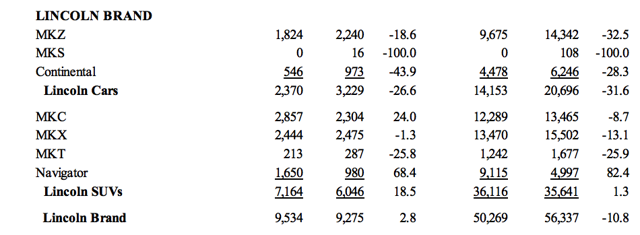

Source: Motor Intelligence  Source: Ford Sales Report June 2018

Source: Ford Sales Report June 2018 Source: Ford Sales Report June 2018

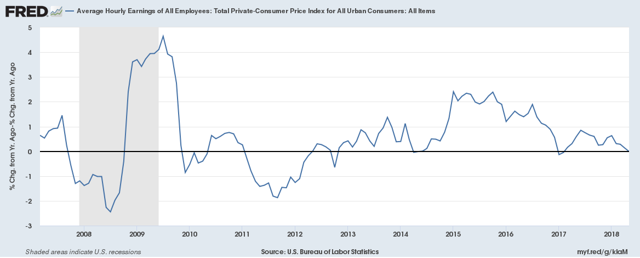

Source: Ford Sales Report June 2018 That being said, I also look at the difference between average hourly earnings growth and the consumer price index to see if the trend from cars to SUVs and trucks might be in danger. It is clearly visible that consumers did benefit from outperforming earnings growth between 2015 and 2017. The trend from cars to bigger vehicles started during this period.

That being said, I also look at the difference between average hourly earnings growth and the consumer price index to see if the trend from cars to SUVs and trucks might be in danger. It is clearly visible that consumers did benefit from outperforming earnings growth between 2015 and 2017. The trend from cars to bigger vehicles started during this period. Takeaway

Takeaway  DnB Asset Management AS increased its position in The Coca-Cola Co (NYSE:KO) by 1.5% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 919,833 shares of the company’s stock after buying an additional 13,500 shares during the quarter. DnB Asset Management AS’s holdings in The Coca-Cola were worth $40,344,000 at the end of the most recent reporting period.

DnB Asset Management AS increased its position in The Coca-Cola Co (NYSE:KO) by 1.5% in the 2nd quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 919,833 shares of the company’s stock after buying an additional 13,500 shares during the quarter. DnB Asset Management AS’s holdings in The Coca-Cola were worth $40,344,000 at the end of the most recent reporting period.  24/7 Wall St.

24/7 Wall St.