Below is the verbatim transcript of Mashruwala's interview with CNBC-TV18.

Q: How retail investors should approach inflation indexed bonds and what are the points that should be kept in mind?

A: The Reserve Bank of India (RBI) has made an announcement about inflation-indexed bonds and the finance minister spoke about this. However, it is a bit early to say. I appreciate the product and it is much better compared to a standard bond whereby principal amount remains intact, same throughout the tenure irrespective of inflation and to that extent if one loses to inflation then they are talking about linking it to Wholesale Price Index (WPI).

The problem is that wholesale price index is not the inflation that a common man suffers. He suffers much higher inflation but it is still better than not having anything. The principal amount will nominally get adjusted based on the inflation numbers. So, if inflation goes up as it usually does then principal amount will be automatically treated to be a higher amount and on that one would pay the interest rate.

Things that a common man should look into while investing into it is (a) what is the initial coupon rate, what is the initial rate of interest because while principal amount nominally will keep going up if the rate of interest is lower compared to what is being offered in other bonds right now then it is not too much of any interest to a person (b) is there liquidity option. There is a good possibility of this happening whereby there will be listing on the stock exchange though we yet to get complete details but after that do small size trade happen.

Therefore, what a retail investor should look for is what is the eventual coupon rate that comes up and the liquidity having said that this is a better product compared to a product whereby for a 10-year the principal remains irrespective of rate of inflation. So, better product but wait and watch.

1 2

Watch Video

Excerpts from Markets and Macros on CNBC-TV18 Watch the full show »

.ftCnbcShare{border-top:#d1d1d1 1px solid; padding:8px;margin-bottom: -27px; margin-top:10px;}

Markets And Macros at 11:00 am

.gD_15nRedN{font:15px/20px Arial;color:#FF0000 !important;text-decoration:none;font-weight:normal;}

Related News

What if 'Karta' in Hindu Undivided Family passes away? IRDA eases short tenor life insurance norms: What it means

.gD_15nRed{font:15px/20px Arial;color:#FF0000 !important;text-decoration:none;font-weight:bold;}

.GoogleNewsTitle{font:14px/16px Trebuchet MS,Arial,Helvetica,sans-serif;color:#005066;text-decoration:none;} .GoogleNewsTitle:hover{text-decoration:underline} .GoogleNewsURL{font:12px Trebuchet MS,Arial,Helvetica,sans-serif;color:#000;text-decoration:none;} .GoogleNewsURL:hover{text-decoration:underline} .GoogleNewsTitleLine{font:20px/22px Trebuchet MS,Arial,Helvetica,sans-serif;color:#F01414;text-decoration:none} .GoogleNewsTitleLine:hover{text-decoration:underline} .GoogleNewsLineURL{font:12px family:Trebuchet MS,Arial,Helvetica,sans-serif;color:#000;text-decoration:none} .GoogleNewsLineURL:hover{text-decoration:underline}

Tags: Gaurav Mashruwala, RBI, inflation indexed bonds, Wholesale Price Index, WPI, equity, debt, gold

Know the finer points in clubbing income with spouse

Hilton Worldwide launches new global careers website

.scroll_hv .panel{width:250px !important; padding:10px 10px 25px !important} #scroll13{width:540px;} .hv_bx{margin-left:-10px;} .tab_data1{padding:0px;}

Jan. 15 (Bloomberg) -- The House passed a $1.1 trillion bipartisan spending bill that would finance the federal government through Sept. 30 and avoid a repeat of October’s partial shutdown. Lawmakers voted 359-67 to send the measure to the Senate, which is set to pass it later this week. Because current funding had been scheduled to lapse tonight, both chambers passed a separate measure pushing the deadline to Jan. 18. The White House-backed spending bill includes $1.01 trillion for U.S. government operations and additional funds for war financing. To reach an agreement, Republicans ceded on their demands to block funding for President Barack Obama’s health- care law, while Democrats voted to spend far less than they proposed earlier this year. “In this agreement, no one gets everything they want,” Representative Nita Lowey of New York, the top Democrat on the House Appropriations Committee, said in an interview today. “It’s a good bill, a solid bill.” Lawmakers agreed on the $1.01 trillion base spending level in December as part of a two-year budget plan. Today’s bill would continue Congress’s trend toward reducing discretionary funds. Spending in fiscal year 2010, including wars and disaster aid, totaled $1.275 trillion, according to the House Appropriations Committee. That compares with today’s $1.1 trillion measure for fiscal 2014, which began Oct. 1 and runs through Sept. 30. 16 Days After a 16-day shutdown in October and years of automatic spending cuts and stopgap bills that took the government from crisis to crisis, lawmakers said they were glad they were finally able to vote on a comprehensive plan. “We ought to recognize that while we’ve had some partisan differences, the legislation was crafted in a bipartisan way,” said Oklahoma Republican Tom Cole, chairman of the subcommittee that oversees legislative operations. “It’s something that we frankly ought to take some pride in.” Appropriators in the House and Senate worked throughout the holidays to craft the bill, and they announced the agreement Jan. 13. Several lawmakers complained they and their staff members didn’t have time to read the whole measure. Massachusetts Democrat Jim McGovern said on the House floor he expected that lawmakers may soon learn it contains provisions they wouldn’t have wanted. Shutdown Alternative Still, he said lawmakers had to back the bill because “the alternative is shutting the government down.” Taxpayers for Common Sense, a Washington-based advocacy group that opposes government waste, said a person would have to read the bill at more than a page a minute, without sleep, to understand the entire measure in time for the vote. “While we’re happy Congress is finally getting its work done -– albeit more than three months late -- this is not how legislation that is funding all of government should be done,” Steve Ellis, vice president for Taxpayers for Common Sense, said in an e-mail. House Appropriations Chairman Hal Rogers, a Kentucky Republican, told the Rules Committee yesterday he hoped the rush was a one-year-only event. “I only wish we could consider each and every bill in this package separately, but unfortunately, the timing gives us one shot and one shot only to get it done,” Rogers said. Regular Cycle Lawmakers have said a more regular appropriations cycle will reduce the threat of shutdowns and provide certainty to businesses and investors. U.S. dollar volatility in the last 90 days fell to 4.52 percent from its one-year high of 7.34 percent last September as a shutdown and debt crisis loomed, according to the Bloomberg U.S. Dollar Index. The index, an indicator of market uncertainty, represents 10 major currencies weighted by liquidity and trade flows. Lowey and Rogers said they intend to pass 12 individual spending bills for fiscal year 2015 before it begins Oct. 1. The last time Congress passed all of its spending bills on time was during the mid-1990s. This week’s agreement will allow Congress to “get the train back on track,” Rogers said. The $1.1 trillion measure is H.R. 3547. The three-day stopgap is H.J.Res. 106.

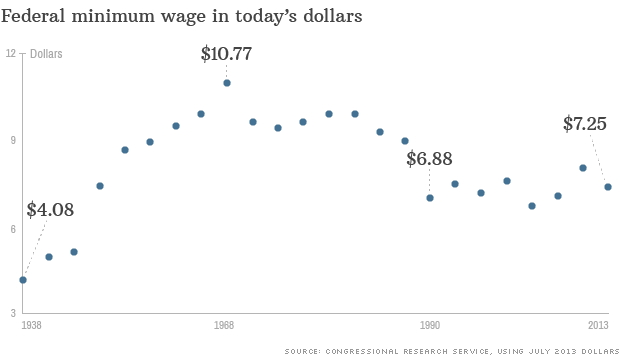

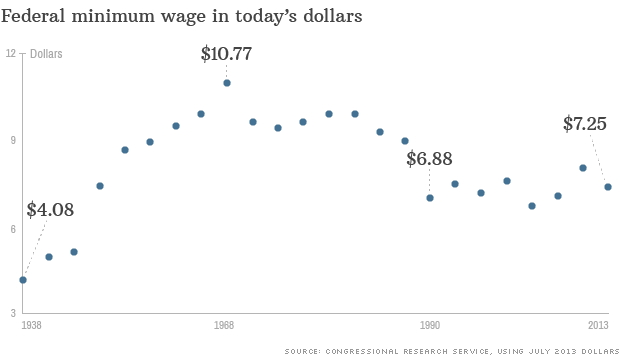

NEW YORK (CNNMoney) A Democratic proposal to raise the federal minimum wage to $10.10 an hour got the backing Tuesday of 75 leading economists. The group includes seven Nobel laureates, among them Joseph Stiglitz and Peter Diamond, and several former Obama and Clinton administration economists. They lent their support to legislation known as the Fair Minimum Wage Act, introduced in the House by Rep. George Miller and in the Senate by Sen. Tom Harkin. "The vast majority of employees who would benefit are adults in working families, disproportionately women, who work at least 20 hours a week and depend on these earnings to make ends meet," the group wrote. The legislation would phase in the minimum wage increase from today's $7.25 an hour to $8.20 in the first year, then to $9.15 the year after and to $10.10 in the third year. Thereafter, it would be indexed to inflation. If the legislation passed, a full-time minimum wage worker would see a bump in pay from about $15,000 a year to roughly $21,000. That could put a family of three above the poverty line. Only about 1.6 million hourly workers currently earn the minimum wage, according the Congressional Research Service. But the Economic Policy Institute, a liberal think tank that organized release of the letter, estimates that another 17 million hourly workers who now earn between $7.25 and $10.10 an hour would see higher wages over the three years of a phased-in increase. And millions more who make above $10.10 would indirectly benefit if employers adjust pay scales commensurate with a minimum wage increase, EPI estimates. The Miller-Harkin proposal would also raise the hourly base for workers paid in tips, initially to $3 from $2.13. After that, the proposal calls for their base to be adjusted annually so t! hat it matches 70% of the federal minimum wage. The economists asserted in their letter that "research suggests that [an increase] could have a small stimulative effect on the economy as low-wage workers spend their additional earnings, raising demand and job growth." Critics say a higher minimum wage will hurt jobs. Their argument: employers will hire fewer people or reduce their hours. And they may compensate for the extra expense in other ways that can hurt consumers, for instance by raising prices. Academic research on this issue, however, is not conclusive. In any case, political analysts don't think there's much chance for passage of a minimum wage hike this year. "I just don't see it getting through the House," said Greg Valliere, chief political strategist for the Potomac Research Group.  Wage wars: The fight for higher pay But the idea is likely to feature prominently in stump speeches during this midterm election year. "This is all about Democrats positioning to run in the elections on an inequality theme. Republicans are going to have a tough time responding, but I highly doubt the response will be to allow a minimum wage hike," said Sean West, U.S. policy director for the Eurasia Group. States don't have to adopt the federal minimum wage, but in states where the minimum wage is different, "the employee is entitled to the higher wage of the two," according to CRS. Just this month, the minimum wage rose in 13 states and four cities.

Although business headlines still tout earnings numbers, many investors have moved past net earnings as a measure of a company's economic output. That's because earnings are very often less trustworthy than cash flow, since earnings are more open to manipulation based on dubious judgment calls. Earnings' unreliability is one of the reasons Foolish investors often flip straight past the income statement to check the cash flow statement. In general, by taking a close look at the cash moving in and out of the business, you can better understand whether the last batch of earnings brought money into the company, or merely disguised a cash gusher with a pretty headline. Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on American Midstream Partners (NYSE: AMID ) , whose recent revenue and earnings are plotted below.  Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. FCF = free cash flow. FY = fiscal year. TTM = trailing 12 months. Over the past 12 months, American Midstream Partners burned $3.5 million cash while it booked a net loss of $11.8 million. That means it burned through all its revenue and more. That doesn't sound so great. All cash is not equal

Unfortunately, the cash flow statement isn't immune from nonsense, either. That's why it pays to take a close look at the components of cash flow from operations, to make sure that the cash flows are of high quality. What does that mean? To me, it means they need to be real and replicable in the upcoming quarters, rather than being offset by continual cash outflows that don't appear on the income statement (such as major capital expenditures). For instance, cash flow based on cash net income and adjustments for non-cash income-statement expenses (like depreciation) is generally favorable. An increase in cash flow based on stiffing your suppliers (by increasing accounts payable for the short term) or shortchanging Uncle Sam on taxes will come back to bite investors later. The same goes for decreasing accounts receivable; this is good to see, but it's ordinary in recessionary times, and you can only increase collections so much. Finally, adding stock-based compensation expense back to cash flows is questionable when a company hands out a lot of equity to employees and uses cash in later periods to buy back those shares. So how does the cash flow at American Midstream Partners look? Take a peek at the chart below, which flags questionable cash flow sources with a red bar.  Source: S&P Capital IQ. Data is current as of last fully reported fiscal quarter. Dollar values in millions. TTM = trailing 12 months. When I say "questionable cash flow sources," I mean items such as changes in taxes payable, tax benefits from stock options, and asset sales, among others. That's not to say that companies booking these as sources of cash flow are weak, or are engaging in any sort of wrongdoing, or that everything that comes up questionable in my graph is automatically bad news. But whenever a company is getting more than, say, 10% of its cash from operations from these dubious sources, investors ought to make sure to refer to the filings and dig in. With 16.3% of operating cash flow coming from questionable sources, American Midstream Partners investors should take a closer look at the underlying numbers. Within the questionable cash flow figure plotted in the TTM period above, stock-based compensation and related tax benefits provided the biggest boost, at 12.1% of cash flow from operations. Overall, the biggest drag on FCF came from capital expenditures. A Foolish final thought

Most investors don't keep tabs on their companies' cash flow. I think that's a mistake. If you take the time to read past the headlines and crack a filing now and then, you're in a much better position to spot potential trouble early. Better yet, you'll improve your odds of finding the underappreciated home-run stocks that provide the market's best returns. Can your retirement portfolio provide you with enough income to last? You'll need more than American Midstream Partners. Learn about crafting a smarter retirement plan in "The Shocking Can't-Miss Truth About Your Retirement." Click here for instant access to this free report. We can help you keep tabs on your companies with My Watchlist, our free, personalized stock tracking service. Add American Midstream Partners to My Watchlist.

There's a digital divide among superstore chains in an era where digital delivery is rendering a lot of physical selling space obsolete. In this video, longtime Fool contributor Rick Munarriz explains why Bed Bath & Beyond (NASDAQ: BBBY ) and Costco (NASDAQ: COST ) are holding up well at a time when Barnes & Noble (NYSE: BKS ) and Best Buy (NYSE: BBY ) are turning to dramatic makeovers to remain relevant. Learn to profit from retail's changing ways

To learn about two retailers with especially good prospects, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform, and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

Tesla (NASDAQ: TSLA ) dazzled a crowd last Thursday night during the electric-vehicle maker's battery swap event in California. The company's CEO, Elon Musk, took the stage to host a demonstration of how Model S owners can recharge their all-electric cars in half the time it takes to refill a traditional car with gas. Seeing is believing

It's game on for gas cars versus EV technology. In just 90 seconds, Tesla can replace your EV's empty battery with a fully charged one. During the presentation Musk explained: When you come to a Tesla supercharging station you have the choice of the supercharger, which is and always will be free... Or, you have the choice of a battery pack swap, which is faster than you can fill a gas tank. ... The only decision that you have to make when you come to one of our Tesla stations is do you prefer faster or free? The audience responded with laughter and you couldn't help feeling as though you'd witnessed the rebirth of the late Steve Jobs. Dressed all in black, Musk's showmanship really drove home the point that electric cars can be just as, if not more, convenient than their gas-guzzling equivalents. With its network of supercharging stations, Tesla is working to address the lack of charging infrastructure that plagues EV adoption in the United States. From the pump to the plug

The swap solution for Tesla's battery pack, will be an option that's available at all Tesla supercharger stations. For about the cost of a tank of gas, between $60 and $80, Tesla drivers can swap their battery for a fully charged one in less than 90 seconds time. According to Reuters, "Drivers who choose to swap must reclaim their original battery on their return trip or pay the difference in cost for the new pack." That seems fair. Meanwhile, for Tesla, the hope is that this added convenience would entice even more drivers to become Tesla EV owners. It's worth mentioning that these battery-swap stations could cost Tesla as much as $100 million to build, according to Musk. Still, that's a worthy investment if it helps Tesla turn more skeptics into believers and more drivers into Tesla EV owners. Electric is the future

Tesla's plan to disrupt the global auto business has yielded spectacular results. From the company's innovative retail strategy to its most recent battery-swap solution. However, giant competitors are already moving to disrupt Tesla. Will the company be able to fend them off? A recent Motley Fool report, "2 Automakers to Buy for a Surging Chinese Market", names two global giants poised to reap big gains that could drive big rewards for investors. You can read this report right now for free -- just click here for instant access.

"I hesitated to write about this trend. It's disturbing. Many of its facets are also politically charged. But as an investor, I have to avoid politics. There's no money to be made by laying blame or opining about what should be. My only job is to find strong trends that support an investable idea." So noted Amy Calistri in the introduction to the most recent issue of Stock of the Month. I'll get to Amy's "investable idea" in a moment. First, some grim realities... Four out of five American adults struggle with joblessness, near-poverty or reliance on welfare at some point in their lives. That's what The Associated Press reported in late July, based on what it said was exclusive survey data. Best Heal Care Stocks To Invest In Right Now: Tim Hortons Inc.(THI) Tim Hortons Inc. develops, franchises, and operates quick service restaurants primarily in Canada and the United States. Its restaurants serve coffee and other hot and cold beverages, baked goods, sandwiches, soups, and other food products. As of April 03, 2011, the company and its restaurant owners operated 3,169 restaurants in Canada and 613 restaurants in the United States under the Tim Hortons name; and had 274 primarily self-serve licensed locations in the Republic of Ireland and the United Kingdom Tim Hortons Inc. was founded in 1964 and is based in Oakville, Canada. Advisors' Opinion: - [By Rich Duprey]

Canadian restaurant chain�Tim Horton's� (NYSE: THI ) �declared today�its regular quarterly dividend of $0.26 per share, slightly higher than the $0.2534 per share it paid back in February.� - [By Eric Volkman]

Tim Hortons (NYSE: THI ) will have a new nameplate on the door of its chief executive's office starting this summer. The company announced that it has named Marc Caira as CEO, effective July 2. He succeeds Paul House, who will remain in his post as chairman of the board. - [By Chad Fraser]

Tim Hortons (NYSE: THI) is Canada’s leading coffee chain, with 3,468 outlets in the country, as well as 807 in the U.S. and 29 in the Middle East.

Best Heal Care Stocks To Invest In Right Now: Kaiser Federal Financial Group Inc.(KFFG) Kaiser Federal Financial Group, Inc. operates as the holding company for Federal Bank that provides retail and commercial banking services to individuals and business customers in California. The company?s deposit products include savings accounts, money market accounts, demand deposit accounts, and certificate of deposit accounts. Its loan portfolio comprises real estate loans consisting of one-to-four family residential, multi-family residential, and commercial real estate loans; and consumer loans, including home equity lines of credit, new and used automobile loans, and loans secured by savings deposits, as well as unsecured loans. The company also offers automated teller machine, bill payment, and Internet banking services. It provides its services through three branch offices and six financial service centers located in California. The company was formerly known as K-Fed Bancorp and changed its name to Kaiser Federal Financial Group, Inc. on November 15, 2010. Kaise r Federal Financial Group, Inc. was founded in 1953 and is headquartered in Covina, California. Solitario Exploration & Royalty Corp., a development stage company, engages in the exploration and acquisition of precious and base metals in Peru, Brazil, Mexico, and Bolivia. The company primarily explores for gold, silver, platinum, palladium, copper, lead, and zinc metals. As of December 31, 2011, it had interests in 12 exploration properties in Peru, Bolivia, Mexico, and Brazil; 2 royalty properties in Peru; and 1 royalty property in Brazil. The company was formerly known as Solitario Resources Corporation and changed its name to Solitario Exploration & Royalty Corp. in June 2008. Solitario Exploration & Royalty Corp. was founded in 1984 and is based in Wheat Ridge, Colorado. Best Heal Care Stocks To Invest In Right Now: Sinobest Technology Hldgs Ltd. (T80.SI) Sinobest Technology Holdings Ltd., an investment holding company, provides computer and network system integration, building integration, application software development, and technical services in the People's Republic of China. It offers e-archive management, social security allied office, public security joint approving, e-document exchange center, e-regulation and policy, e-conference, e-financial management, and performance assessment solutions for the government; and government internal Website portal, short message service, office automation, email, decision making support, information service management, and service management information solutions for public servants. The company also offers online applying and approving, and enterprise information service solutions for businesses; community service, e-Medicare, online applying and approving, public information service, e-identity verification, and hotline service solutions for public; and application support, ser vice application, and network infrastructure solutions. It primarily serves government bureaus and departments, and state-owned enterprises in the sectors of telecommunication service, power supply, railway and transportation, immigration and customs, public security, labor and social insurance, universities, land and resources, taxation and finance, and food and drugs, as well as privately-owned enterprises. The company was founded in 1997 and is headquartered in Guangzhou, the People's Republic of China Sinobest Technology Holdings Ltd. is a subsidiary of Profit Saver International Limited. Best Heal Care Stocks To Invest In Right Now: First Financial Northwest Inc.(FFNW) First Financial Northwest, Inc. operates as the holding company for First Savings Bank Northwest that provides community-based savings bank services in Washington. Its deposit products include noninterest bearing accounts, NOW accounts, money market deposit accounts, statement savings accounts, and certificates of deposit. The company?s loan products portfolio comprises one-to-four family residential loans, multifamily loans, commercial real estate loans, construction/land development loans, and business loans, as well as consumer loans, including home equity loans, personal lines of credit, second mortgage loans, and savings account loans. First Financial Northwest, Inc., through another subsidiary, First Financial Diversified, Inc., offers escrow services. The company primarily serves customers in the King, Pierce, Snohomish, and Kitsap counties of Washington through a full-service banking office in Renton, Washington. First Financial Northwest, Inc. was founded in 1923 and is based in Renton, Washington. Advisors' Opinion: - [By Jim Royal]

One of my favorite reasons to reinvest in stocks I already own is when an uncertain, but favorable catalyst occurs, but the stock does little. So my Special Situations portfolio is adding $1,000 to each of the following three stocks: Cincinnati Bell (NYSE: CBB ) , Bridgepoint Education (NYSE: BPI ) , and First Financial Northwest (NASDAQ: FFNW ) . Read on to see why.

Best Heal Care Stocks To Invest In Right Now: Network Equipment Technologies Inc.(NWK) Network Equipment Technologies, Inc. (NET), together with its subsidiaries, engages in the design, development, manufacture, and sale of voice and data telecommunications equipment for multi-service networks and associated services used by government organizations, enterprises, and carriers worldwide. The company offers voice solutions, such as the VX Series and the Quintum Series of switching media gateways that provide enterprise customers with voice interoperability solutions, IP-based solutions to government agencies, and traditional VoIP switching gateway solutions for SMBs and smaller branch offices within large enterprises. It offers multi-service solutions, which comprise Promina product line, a multi-service platform that provides network reliability and security; NX1000 platform, which offers a WAN switching solution to enable applications to integrate and aggregate into IP-based networks; and NX5010 platform that enables secure interconnection and extension of g eographically distributed grid computing clusters and storage area networks, providing data transfer. The company also offers SmartSIP product that allows standard SIP phones to be provisioned and used as extensions in a Microsoft Lync Server 2010 deployment. In addition, it provides installation and other professional services; hardware and software maintenance programs, parts repair, remote and on-site technical assistance, and customer training; and Web-based services. The company serves government customers, which include various federal and international agencies and organizations, such as civilian and defense agencies, and resellers to such entities; and enterprise customers comprising large enterprises, and small-to mid-sized businesses in various sectors. NET sells its products directly, as well as through relationships with integrators, resellers, and vendors of related technologies. The company was founded in 1983 and is headquartered in Fremont, California.

I bet you've never heard of this... It's a special government loophole... that allows you to earn extra cash, totally tax-free. It's 100% legal and simple to use. It can even help you pay for a dream vacation home. This loophole is not for everyone. But if you qualify, you should start collecting this income right away. I call this loophole the "Masters exemption." That's because every year, visitors flock to Augusta, Georgia for the Masters Golf Tournament. And many years ago, the very wealthy course owners lobbied their buddies in Washington, asking for special "consideration"... In exchange for the hospitality of the locals, they convinced the lawmakers to allow them to "hide" two weeks of rental income from the IRS... The best part is the loophole isn't just for landowners in Augusta. The IRS allows anyone to rent a vacation or rental property (not a primary residence) anywhere in the country for up to 14 days each year... and pay no taxes on the rental income. Plus, there's NO limit on the amount you can charge and collect tax-free. I've personally taken advantage of the "Masters exemption" for the last decade. I own a home within earshot of the course where they hold the Masters. Every year, I rent it for the week (or two) of the tournament. Every year, I recoup nearly four months of mortgage payments and property taxes, all tax-free. It's simple to find renters, too... Today, I rely on word of mouth to find my tenants. But I have used Craigslist and the local papers. (The Masters Tournament has a section on its website where you can post your rental listing... although it takes 7% of your income if you do it through them.) First, I conduct an informal personal background check. I contact their office, their landlord (if they have one), and any other references they provide. And I've never really had a problem. One tenant smoked in the house... but I charged him around $500 for cleaning costs. He paid the charge, no questions asked. So if you own a rental or vacation property anywhere in the U.S., you should immediately consider taking advantage of the "Masters exemption" yourself. It's especially easy if you're in a city that's hosting a Super Bowl, World Series, or any sort of professional championship. But wherever your home is... and whatever the season is... here's an opportunity for you to capture easy, tax-free income. That's true even if you already rent your property out the rest of the year... You just need to have a clause (like I do) that requires your tenants to vacate the property during the "high season." This is how many of the homeowners in Augusta do it. Obviously, this loophole won't work for everyone. But if you have a second home, the Masters exemption is a low-risk way to put it to work for you. You can earn safe, tax-free income. And you can potentially make enough money every year to pay for the cash costs and upkeep on your own home. I do it every year. And you can do it, too. Here's to our health, wealth, and a great retirement, Dr. David Eifrig

In early August SemGroup (SEMG), an owner and operator of oil and gas midstream assets, including pipelines and storage and blending facilities, closed on an opportunistic purchase of assets from Chesapeake Energy. The assets nicely complement SemGroup's existing core assets that stretch from Colorado to Oklahoma. While SemGroup will have to spend money to complete the assets—money that financially distressed Chesapeake likely could not justify—we view the expenditures favorably given their high return characteristics.From Third Avenue Management's fourth quarter 2013 commentary. Also check out: Third Avenue Management Undervalued Stocks Third Avenue Management Top Growth Companies Third Avenue Management High Yield stocks, and Stocks that Third Avenue Management keeps buying | Currently 4.00/512345 Rating: 4.0/5 (1 vote) |

Subscribe via Email  Subscribe RSS Comments Please leave your comment: More GuruFocus Links | Latest Guru Picks | Value Strategies | | Warren Buffett Portfolio | Ben Graham Net-Net | | Real Time Picks | Buffett-Munger Screener | | Aggregated Portfolio | Undervalued Predictable | | ETFs, Options | Low P/S Companies | | Insider Trends | 10-Year Financials | | 52-Week Lows | Interactive Charts | | Model Portfolios | DCF Calculator | RSS Feed  | Monthly Newsletters | | The All-In-One Screener | Portfolio Tracking Tool | MORE GURUFOCUS LINKS | Latest Guru Picks | Value Strategies | | Warren Buffett Portfolio | Ben Graham Net-Net | | Real Time Picks | Buffett-Munger Screener | | Aggregated Portfolio | Undervalued Predictable | | ETFs, Options | Low P/S Companies | | Insider Trends | 10-Year Financials | | 52-Week Lows | Interactive Charts | | Model Portfolios | DCF Calculator | RSS Feed  | Monthly Newsletters | | The All-In-One Screener | Portfolio Tracking Tool | SEMG STOCK PRICE CHART  61.01 (1y: +60%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SEMG', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355983200000,38.07],[1356069600000,38.41],[1356328800000,38],[1356501600000,37.77],[1356588000000,37.81],[1356674400000,37.8],[1356933600000,39.08],[1357106400000,40.38],[1357192800000,40.37],[1357279200000,40.6],[1357538400000,40.61],[1357624800000,40.89],[1357711200000,42.05],[1357797600000,41.88],[1357884000000,41.84],[1358143200000,41.85],[1358229600000,41.69],[1358316000000,41.49],[1358402400000,41.69],[1358488800000,41.84],[1358834400000,41.8],[1358920800000,41.24],[1359007200000,41.59],[1359093600000,41.96],[1359352800000,42.12],[1359439200000,42.58],[1359525600000,43.12],[1359612000000,43.16],[1359698400000,44.57],[1359957600000,44.71],[1360044000000,45.34],[1360130400000,46.01],[1360216800000,46.35],[1360303200000,46.7],[1360562400000,47.03],[1360648800000,47.51],[1360735200000,47.81],[1360821600000,47.5],[1360908000000,47.27],[1361253600000,47.05],[1361340000000,45.99],[1361426400000,45.73],[1361512800000,46.68],[1361772000000,45.59],[1361858400000,45.19],[1361944800000,45.84],[1362031200000,46.09],[1362117600000,47.65],[1362376800000,47.5],[1362463200000,47.83],[1362549600000,47.32],[1362636000000,48],[1362722400000,47.96],[1362978000000,48.07],[1363064400000,48.02],[1363150800000,48.36],[1363237200000,48.57],[1363323600000,48.82],[1363582800000,50],[1363669200000,49.75],[1363755600000,49.89],[1363842000000,50.1],[1363928400000,50.69],[1364187600000,51.35],[1364274000000,51.37],[1364360400000,51.47],[1364446800000,51.72],[1364792400000,51.27],[1364878800000,51.19],[1364965200000,50.1],[1365051600000,50.54],[1365138000000,49.75],[1365397200000,49.85],[1365483600000,49.82],[1365570000000,53],[1365656400000,54.04],[1365742800000,52.92],[1366002000000,50.37],[1366088400000,51.2],[1366174800000,50.58],[1366261200000,50.62],[1366347600000,51.53],[1366606800000,52.15],[1366693200000,52.71],[1366779600000,53.15],[1366866000000,52.39],[1366952400000,51.76],[1367211600000,51.91],[1367298000000,51.85],[1367384400000,53.26],[1367470800000,54.12],[1367557200000,55.05],[1367816400000,54.75],[13679028! 00000,54.68],[1367989200000,54.84],[1368075600000,55.9],[1368162000000,55.61],[1368421200000,54.84],[1368507600000,55.16],[1368594000000,56.2],[1368680400000,55.65],[1368766800000,56.12],[1369026000000,57.21],[1369112400000,57.14],[1369198800000,55.66],[1369285200000,55.21],[1369371600000,54.5],[13697172000

|

Popular Posts: 4 Pharmaceutical Stocks to Buy Now8 Oil and Gas Stocks to Buy Now5 Pharmaceutical Stocks to Buy Now Recent Posts: 6 Biotechnology Stocks to Buy Now 4 Commercial Services Stocks to Buy Now 33 Commercial Banking Stocks to Buy Now View All Posts

Popular Posts: 4 Pharmaceutical Stocks to Buy Now8 Oil and Gas Stocks to Buy Now5 Pharmaceutical Stocks to Buy Now Recent Posts: 6 Biotechnology Stocks to Buy Now 4 Commercial Services Stocks to Buy Now 33 Commercial Banking Stocks to Buy Now View All Posts

NEW YORK (CNNMoney) A Democratic proposal to raise the federal minimum wage to $10.10 an hour got the backing Tuesday of 75 leading economists.

NEW YORK (CNNMoney) A Democratic proposal to raise the federal minimum wage to $10.10 an hour got the backing Tuesday of 75 leading economists.  Wage wars: The fight for higher pay

Wage wars: The fight for higher pay

61.01 (1y: +60%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SEMG', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355983200000,38.07],[1356069600000,38.41],[1356328800000,38],[1356501600000,37.77],[1356588000000,37.81],[1356674400000,37.8],[1356933600000,39.08],[1357106400000,40.38],[1357192800000,40.37],[1357279200000,40.6],[1357538400000,40.61],[1357624800000,40.89],[1357711200000,42.05],[1357797600000,41.88],[1357884000000,41.84],[1358143200000,41.85],[1358229600000,41.69],[1358316000000,41.49],[1358402400000,41.69],[1358488800000,41.84],[1358834400000,41.8],[1358920800000,41.24],[1359007200000,41.59],[1359093600000,41.96],[1359352800000,42.12],[1359439200000,42.58],[1359525600000,43.12],[1359612000000,43.16],[1359698400000,44.57],[1359957600000,44.71],[1360044000000,45.34],[1360130400000,46.01],[1360216800000,46.35],[1360303200000,46.7],[1360562400000,47.03],[1360648800000,47.51],[1360735200000,47.81],[1360821600000,47.5],[1360908000000,47.27],[1361253600000,47.05],[1361340000000,45.99],[1361426400000,45.73],[1361512800000,46.68],[1361772000000,45.59],[1361858400000,45.19],[1361944800000,45.84],[1362031200000,46.09],[1362117600000,47.65],[1362376800000,47.5],[1362463200000,47.83],[1362549600000,47.32],[1362636000000,48],[1362722400000,47.96],[1362978000000,48.07],[1363064400000,48.02],[1363150800000,48.36],[1363237200000,48.57],[1363323600000,48.82],[1363582800000,50],[1363669200000,49.75],[1363755600000,49.89],[1363842000000,50.1],[1363928400000,50.69],[1364187600000,51.35],[1364274000000,51.37],[1364360400000,51.47],[1364446800000,51.72],[1364792400000,51.27],[1364878800000,51.19],[1364965200000,50.1],[1365051600000,50.54],[1365138000000,49.75],[1365397200000,49.85],[1365483600000,49.82],[1365570000000,53],[1365656400000,54.04],[1365742800000,52.92],[1366002000000,50.37],[1366088400000,51.2],[1366174800000,50.58],[1366261200000,50.62],[1366347600000,51.53],[1366606800000,52.15],[1366693200000,52.71],[1366779600000,53.15],[1366866000000,52.39],[1366952400000,51.76],[1367211600000,51.91],[1367298000000,51.85],[1367384400000,53.26],[1367470800000,54.12],[1367557200000,55.05],[1367816400000,54.75],[13679028! 00000,54.68],[1367989200000,54.84],[1368075600000,55.9],[1368162000000,55.61],[1368421200000,54.84],[1368507600000,55.16],[1368594000000,56.2],[1368680400000,55.65],[1368766800000,56.12],[1369026000000,57.21],[1369112400000,57.14],[1369198800000,55.66],[1369285200000,55.21],[1369371600000,54.5],[13697172000

61.01 (1y: +60%) $(function() { var seriesOptions = [], yAxisOptions = [], name = 'SEMG', display = ''; Highcharts.setOptions({ global: { useUTC: true } }); var d = new Date(); $current_day = d.getDay(); if ($current_day == 5 || $current_day == 0 || $current_day == 6){ day = 4; } else{ day = 7; } seriesOptions[0] = { id : name, animation:false, color: '#4572A7', lineWidth: 1, name : name.toUpperCase() + ' stock price', threshold : null, data : [[1355983200000,38.07],[1356069600000,38.41],[1356328800000,38],[1356501600000,37.77],[1356588000000,37.81],[1356674400000,37.8],[1356933600000,39.08],[1357106400000,40.38],[1357192800000,40.37],[1357279200000,40.6],[1357538400000,40.61],[1357624800000,40.89],[1357711200000,42.05],[1357797600000,41.88],[1357884000000,41.84],[1358143200000,41.85],[1358229600000,41.69],[1358316000000,41.49],[1358402400000,41.69],[1358488800000,41.84],[1358834400000,41.8],[1358920800000,41.24],[1359007200000,41.59],[1359093600000,41.96],[1359352800000,42.12],[1359439200000,42.58],[1359525600000,43.12],[1359612000000,43.16],[1359698400000,44.57],[1359957600000,44.71],[1360044000000,45.34],[1360130400000,46.01],[1360216800000,46.35],[1360303200000,46.7],[1360562400000,47.03],[1360648800000,47.51],[1360735200000,47.81],[1360821600000,47.5],[1360908000000,47.27],[1361253600000,47.05],[1361340000000,45.99],[1361426400000,45.73],[1361512800000,46.68],[1361772000000,45.59],[1361858400000,45.19],[1361944800000,45.84],[1362031200000,46.09],[1362117600000,47.65],[1362376800000,47.5],[1362463200000,47.83],[1362549600000,47.32],[1362636000000,48],[1362722400000,47.96],[1362978000000,48.07],[1363064400000,48.02],[1363150800000,48.36],[1363237200000,48.57],[1363323600000,48.82],[1363582800000,50],[1363669200000,49.75],[1363755600000,49.89],[1363842000000,50.1],[1363928400000,50.69],[1364187600000,51.35],[1364274000000,51.37],[1364360400000,51.47],[1364446800000,51.72],[1364792400000,51.27],[1364878800000,51.19],[1364965200000,50.1],[1365051600000,50.54],[1365138000000,49.75],[1365397200000,49.85],[1365483600000,49.82],[1365570000000,53],[1365656400000,54.04],[1365742800000,52.92],[1366002000000,50.37],[1366088400000,51.2],[1366174800000,50.58],[1366261200000,50.62],[1366347600000,51.53],[1366606800000,52.15],[1366693200000,52.71],[1366779600000,53.15],[1366866000000,52.39],[1366952400000,51.76],[1367211600000,51.91],[1367298000000,51.85],[1367384400000,53.26],[1367470800000,54.12],[1367557200000,55.05],[1367816400000,54.75],[13679028! 00000,54.68],[1367989200000,54.84],[1368075600000,55.9],[1368162000000,55.61],[1368421200000,54.84],[1368507600000,55.16],[1368594000000,56.2],[1368680400000,55.65],[1368766800000,56.12],[1369026000000,57.21],[1369112400000,57.14],[1369198800000,55.66],[1369285200000,55.21],[1369371600000,54.5],[13697172000